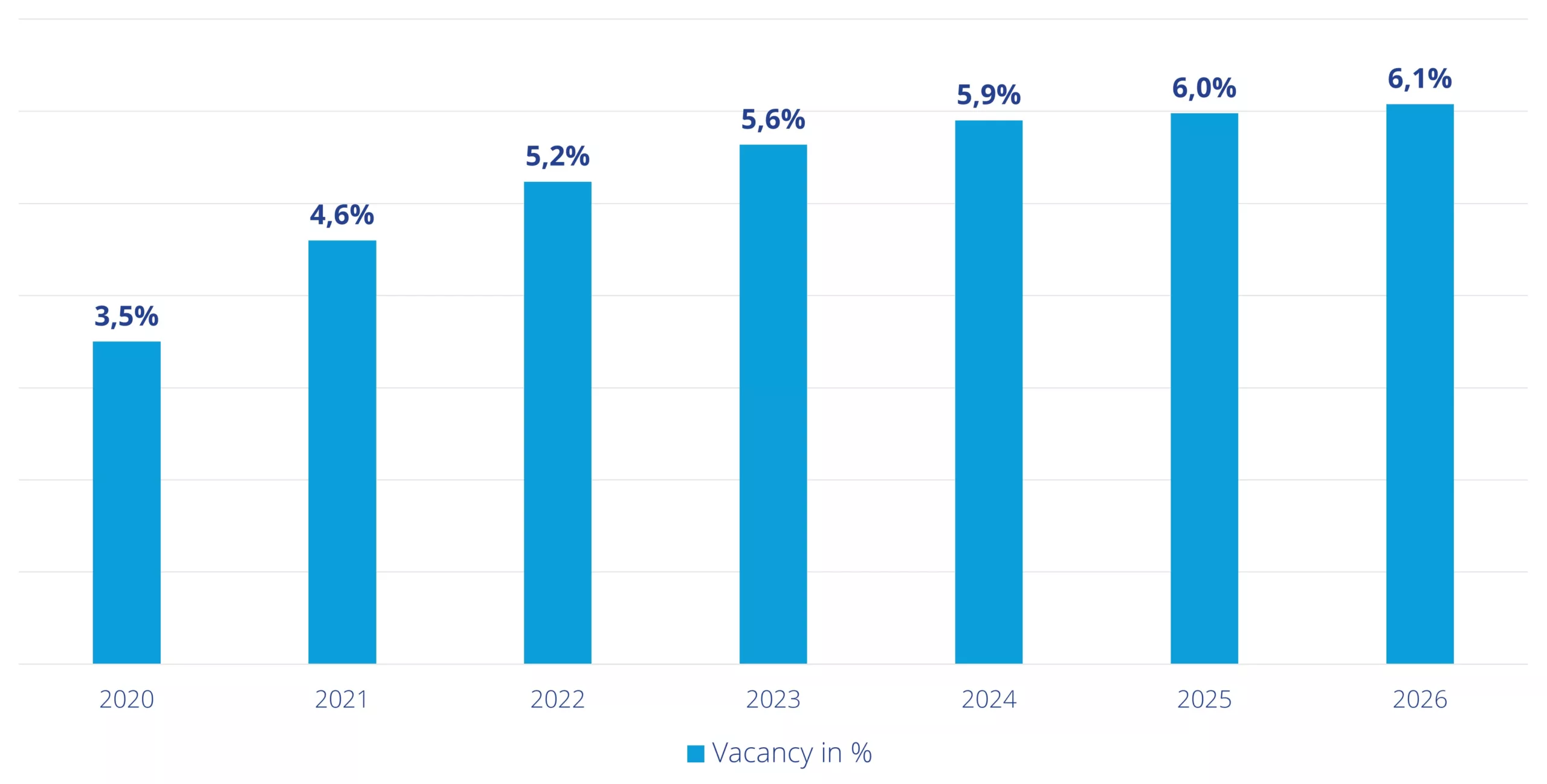

Office vacancy to increase only slightly by 2026

Despite the recession currently encroaching upon Germany, office vacancy in the country’s top 7 cities is only expected to increase 0.9 percentage points from a current 5.2% to 6.1% by 2026. These are some of the key findings of our Market Intelligence & Foresight team’s latest vacancy forecast.

I believe that the current vacancy trend holds three key takeaways for investors, owners and property developers:

- The times of extremely low vacancy rates are over.

- We can nevertheless expect to see moderate growth in rent prices as vacancy rates are poised to remain relatively market-neutral according to our forecast.

- At the same time, we are also going to see a more varied picture around rent prices based on asset location and quality.

Vacancy trend 2020-2026

Demand expected to take a slight breather before picking up speed

The recession is going to put the brakes on demand for office space somewhat in 2023. Take-up is likely to come in around 8% below the long-term average. However, we can look for take-up to pick up speed again as early as 2024 with the trend pointing to a return to the long-term average. There are two factors impacting this trend:

- The amount of space required per employee has dropped with the introduction of new work models.

- At the same time, we are also seeing an increase in the number of office workers, which will have a favorable impact on net absorption going forward.

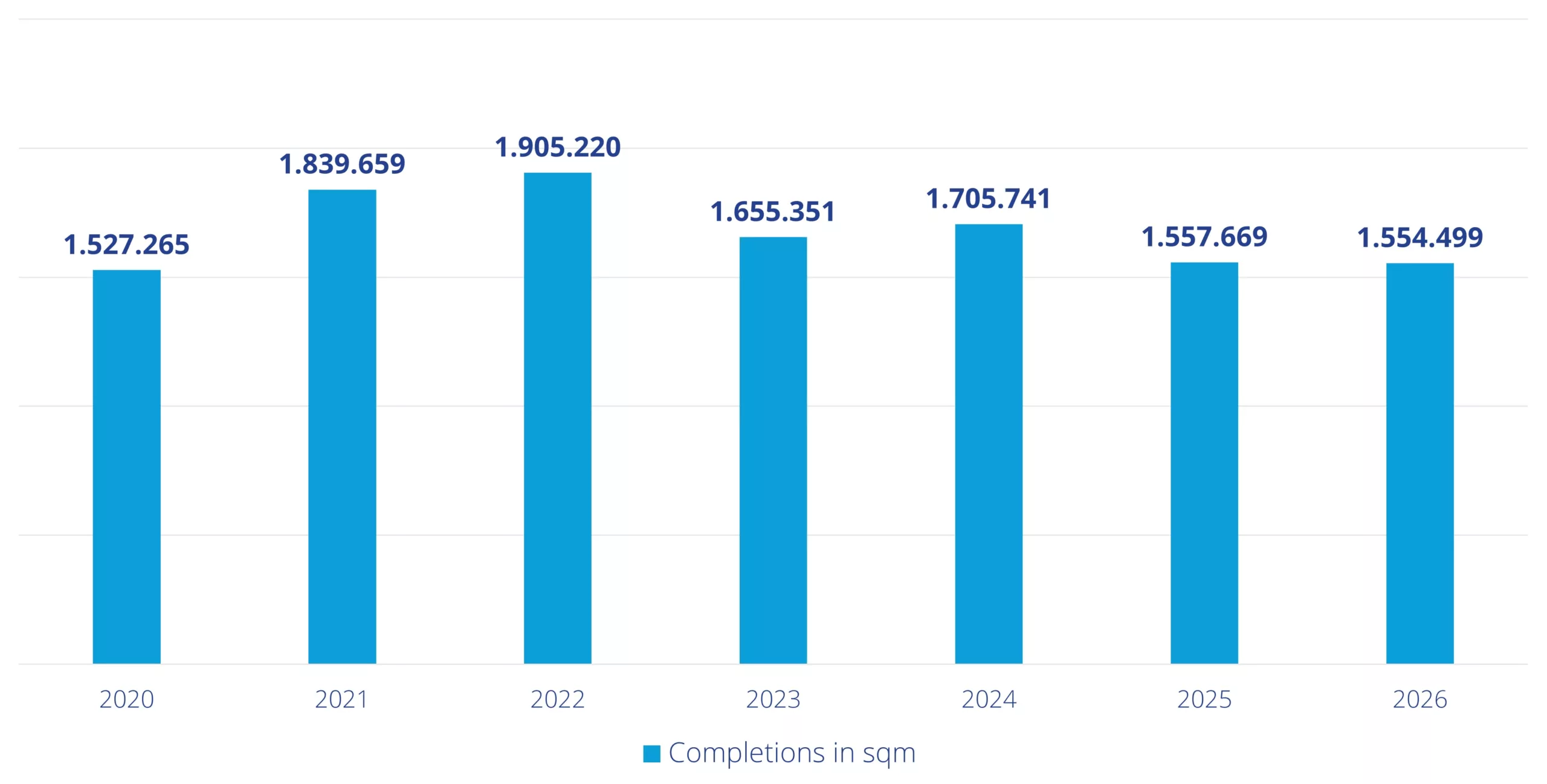

Completion volumes set to drop as of 2025

We are seeing property developers taking a more hesitant stance in the current market environment when it comes to their planned developments and, at the moment, they seem to only be building what they have to build. This stance, however, won’t have an impact on the market until 2025. Projects that are currently underway are being completed, which means we can expect construction volumes to stay strong through late 2024.

This anticipated trend brings with it three key takeaways for the real estate market:

- Companies thinking about moving into a new-build currently have a window of opportunity as new-build space is still available.

- Speculative property developments are going to become few and far between due to challenging financing conditions and rising construction costs.

- The drop in completion volumes as of 2025 will keep vacancy rates low.

Completions 2020-2026

The Market Intelligence & Foresight team has their finger on the pulse of these and other trends on the German real estate market. Feel free to contact me if you are interested in learning more about the anticipated trends covered here, for example taking a deep dive into a certain location.